Starboard Value 13D Filing Analysis: Rogers Corp Activist Stake

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on my comprehensive analysis of the available data, I can provide a detailed assessment of the investor intent behind the Form 13D/A filing for Rogers Corp and its potential implications.

Starboard Value, a prominent activist hedge fund, has built a

- 13D vs. 13G Distinction: The 13D filing (rather than the passive 13G) signals Starboard’s intention to actively engage with management and pursue strategic changes [2]

- Board Representation Demand: Starboard has sought seats on Rogers’ board of directors [1]

- Prior Engagement History: This marks Starboard’s second activist campaign at Rogers, having initially built a position and sought board representation in 2023 [1]

Starboard Value’s objectives, as disclosed in their regulatory filings and subsequent statements, center on the following priorities:

Objective |

Description |

|---|---|

Board Influence |

Seeking representation on Rogers’ board to directly参与战略决策 |

Operational Improvements |

Pushing for cost reduction and operational efficiency measures |

Growth Initiatives |

Advocating for strategies to accelerate revenue growth |

Capital Allocation |

Pressuring management to optimize capital deployment and shareholder returns |

Starboard Value is known for its methodical approach to unlocking shareholder value, typically through a combination of board representation, cost-cutting initiatives, strategic asset sales, and operational restructuring. Their involvement typically signals dissatisfaction with current management strategies or execution [1][2].

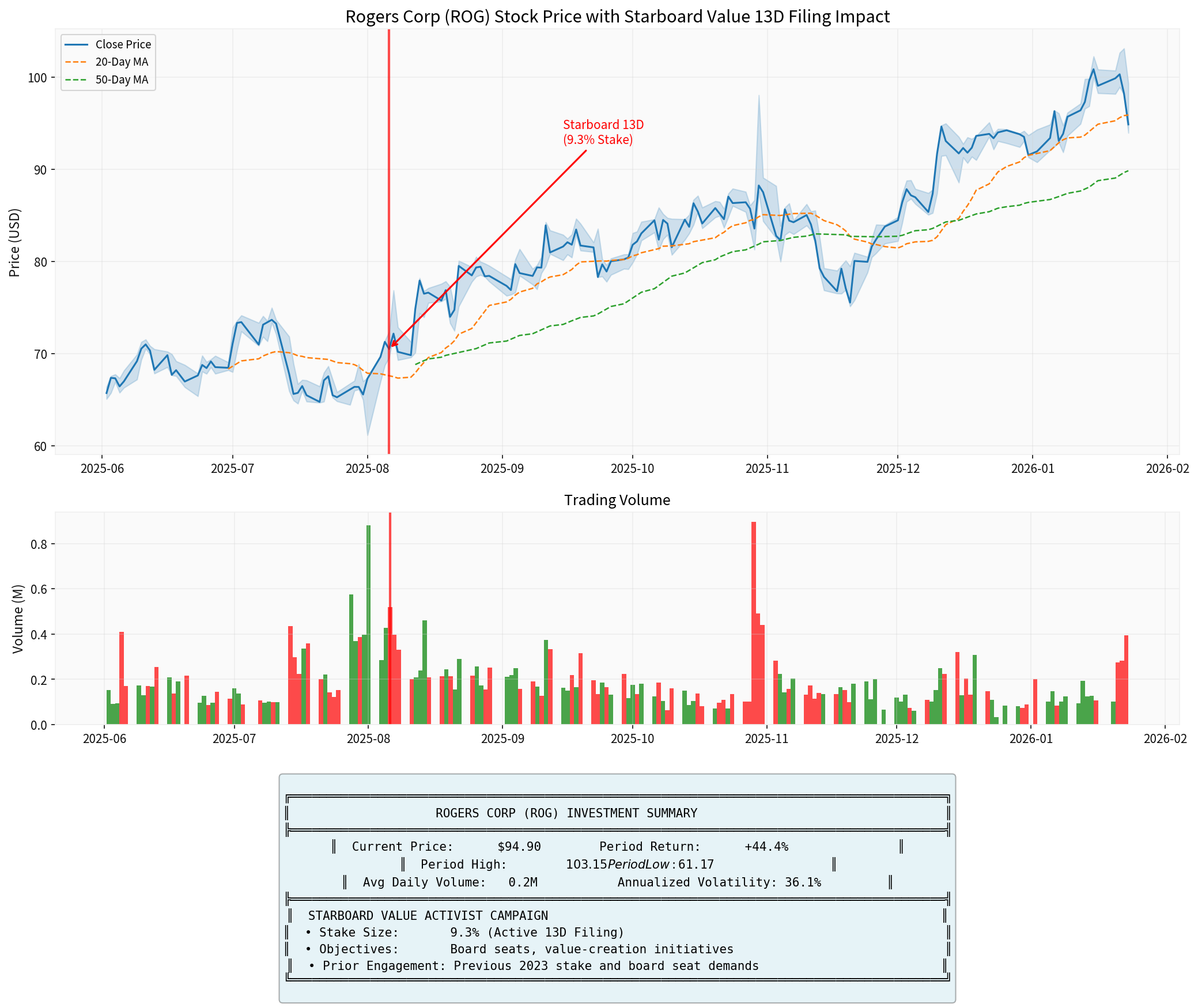

The market responded positively to Starboard’s activist campaign:

- Immediate Reaction: Shares rose approximately10% in extended tradingfollowing the August 6, 2025 announcement of the 13D filing [1]

- Subsequent Performance: The stock has demonstrated strong momentum, with the price increasing by+17.86%over the analysis period (from $80.52 to $94.90) [0]

- Technical Indicators: The stock currently trades above both its 20-day moving average ($95.92) and 50-day moving average ($89.87), indicating positive technical momentum [0]

Starboard Value’s activist campaign is likely to influence Rogers’ future strategic direction in several ways:

- Potential addition of Starboard-nominated directors to the board

- Increased accountability and scrutiny of management decisions

- More active oversight of strategic initiatives

- Pressure to reduce manufacturing and operating costs

- Potential facility rationalization or workforce optimization

- Focus on core competencies and profitable product lines

- Review of capital expenditure programs

- Potential share repurchase programs or dividend increases

- Scrutiny of merger and acquisition strategy

- Potential pressure to explore strategic alternatives, including a sale of the company

- Focus on high-growth segments (EV/HEV, automotive safety, wireless infrastructure)

- Divestiture of non-core or underperforming business units

Rogers Corporation’s recent financial performance provides important context for understanding the activist campaign:

Metric |

Q3 2025 |

Q2 2025 |

Change |

|---|---|---|---|

| Net Sales | $216.0M | $202.8M | +6.5% |

| Gross Margin | 33.5% | 31.6% | +190 bps |

| Adjusted EPS | $0.90 | $0.34 | +164.7% |

| Adjusted EBITDA | $37.2M | $23.9M | +55.6% |

| Free Cash Flow | $21.2M | $5.6M | +278.6% |

The company has shown meaningful improvement in recent quarters, with new management implementing “reacceleration initiatives” [0]. However, the company still faces challenges, including restructuring charges in European operations and ongoing competitive pressures in its end markets.

The activist campaign may positively impact Rogers’ valuation through several mechanisms:

-

Multiple Expansion: If Starboard successfully implements value-creation initiatives, the market may award a higher P/E multiple to reflect improved operational execution and reduced risk

-

Earnings Uplift: Cost reduction initiatives and operational improvements could drive earnings upgrades beyond current analyst consensus

-

Strategic Alternatives Premium: Pressure to explore strategic alternatives could unlock value through a potential acquisition premium

-

Reduced Uncertainty: Activist involvement often reduces uncertainty around company strategy and execution, which can attract more institutional investors

Investors should also consider potential risks associated with the activist campaign:

Risk |

Description |

|---|---|

Execution Uncertainty |

Starboard’s initiatives may not be successfully implemented |

Management Disruption |

Potential conflict between activists and existing management |

Short-term Focus |

Activists may prioritize short-term gains over long-term value creation |

Market Conditions |

Weakness in key end markets (automotive, industrial) could offset operational improvements |

Starboard Value’s 9.3% stake and Form 13D filing represent a significant activist campaign targeting Rogers Corporation. The investor’s intent centers on securing board representation and driving strategic changes to enhance shareholder value. The market’s positive reaction reflects optimism that activist pressure will lead to improved operational performance and strategic clarity.

Given Rogers’ recent operational improvements and Starboard’s track record of successful value creation, this activist campaign has the potential to positively impact the company’s future strategy and stock valuation. However, investors should monitor developments closely, including any board appointments, strategic announcements, and quarterly results, to assess the ultimate impact of Starboard’s involvement.

[1] Reuters - “Activist investor Starboard builds over 9% stake in Rogers” (https://www.reuters.com/sustainability/sustainable-finance-reporting/activist-investor-starboard-builds-over-9-stake-rogers-2025-08-06/)

[2] 13D Monitor Quarterly Report - June 2025 (https://www.13dmonitor.com/Download.aspx?t=3&f=June+2025+Allocator+Edition.pdf)

[0] 金灵AI金融数据库 - Rogers Corp市场数据与财务分析

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。