Syria Ceasefire Expiration: Energy Market and Investment Risk Analysis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

Based on my comprehensive research, I can provide you with a detailed analysis of the Syria ceasefire expiration and its potential market implications.

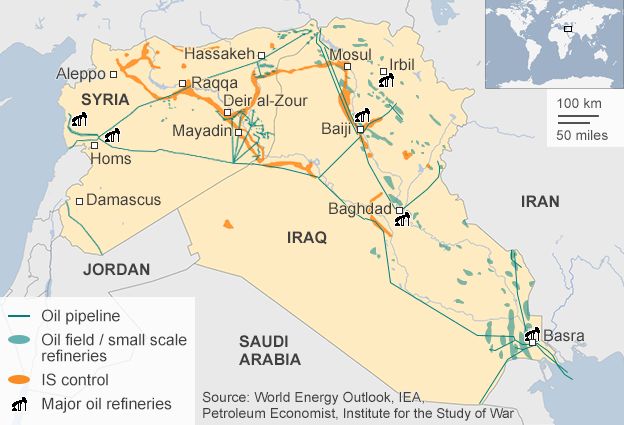

The ceasefire between Syrian government forces and the Kurdish-led Syrian Democratic Forces (SDF) has effectively collapsed, with significant developments occurring in mid-January 2026. Syrian Arab Army (SAA) forces have reasserted control over approximately 400 km² of previously SDF-held territory in northeastern Syria, including the strategic town of Kobani and surrounding villages [1]. This military offensive has fundamentally altered the regional dynamics and created new uncertainties for energy markets and investment risk assessment in the Middle East.

The SAA advance from the strategic town of Qamishli toward Kobani represents a significant territorial shift that had been contested since the 2017-2018 Turkish-Syrian-U.S. operations [1]. Local Kurdish councils report that the Syrian government has established provisional civil administration in captured areas, with explicit plans to integrate these regions into the national governance structure. This development has raised substantial concerns among regional actors and international stakeholders regarding the sustainability of recent territorial arrangements.

The capture of oil infrastructure represents perhaps the most significant dimension of this conflict for energy markets. Syrian government forces have seized the

Additionally, the SAA has captured the

The broader northeastern region, particularly the al-Hasakah governorate, contains Syria’s most significant oil fields. While Syria’s total pre-war oil production of approximately 380,000 barrels per day has been substantially reduced due to conflict damage, sanctions, and infrastructure degradation, the eastern fields remain strategically important for any future reconstruction efforts. The transfer of control from Kurdish authorities to Damascus central government creates both operational risks and potential opportunities for future production restoration.

Analysts project a

-

Supply Uncertainty: The transition of oil field control creates operational uncertainty, with potential for production disruptions during the administrative handover period.

-

Pipeline Constraints: Iraq’s downstream export pipeline, connecting to the Euphrates corridor, may face temporary capacity constraints until the new administration stabilizes operations [1]. This pipeline represents a critical transit route for regional oil exports.

-

Regional Spillover Effects: The conflict’s proximity to major oil production and transit infrastructure in Iraq, Turkey, and the Persian Gulf region creates broader market sensitivity.

Current market data indicates Brent Crude trading at approximately

The ceasefire collapse introduces multiple dimensions of investment risk for Middle East-related assets:

- Turkish Concerns: The Turkish government has expressed alarm that the SAA’s push into Kurdish areas may create a new “security vacuum” and potentially revive ISIS cells that had been previously dislodged [1]. This concern is particularly relevant given Turkey’s ongoing security operations against Kurdish groups in the region.

- Russian Involvement: Russia, maintaining a military base at Rassvet, has called for multilateral dialogue to avoid further escalation, noting risks of spillover into the broader Middle East security architecture [1].

- U.S. Interests: The U.S. has warned that the shift could undermine its security guarantees to Kurdish forces and potentially impact planned pipeline projects between Iraq and Turkey that rely on stable regional arrangements [1].

- The takeover of the Kobanî Dam has prompted Iraqi water-resource concerns, potentially affecting hydropower output in northeastern basins and prompting increased LNG imports to Iraq [1].

- Regional energy security dynamics may shift as Syria’s new government establishes control over previously autonomous oil-producing regions.

Recent U.S. market data shows the

| Sector | Risk Level | Key Concerns |

|---|---|---|

Energy |

Moderate | Oil field control transitions, pipeline security, potential production disruptions |

Financial Services |

Elevated | Risk-off sentiment, regional investment uncertainty, currency volatility |

Industrials |

Moderate | Infrastructure project delays, supply chain disruptions |

Consumer Defensive |

Low | Limited direct exposure, potential inflation pass-through |

Utilities |

Low-Moderate | Water resource management concerns in affected regions |

-

Geographic Diversification: Investors with Middle East exposure should assess portfolio concentrations in Syria-adjacent markets, particularly Turkey and Iraq, where spillover effects are most likely.

-

Commodity Hedging: Given the potential for short-term oil price volatility, appropriate hedging strategies may be warranted for portfolios sensitive to energy price movements.

-

Monitoring Parameters: Key indicators to monitor include:

- Syrian oil production and export volumes

- Pipeline throughput in Iraq-Turkey corridor

- Regional diplomatic developments (U.S., Russia, Turkey positioning)

- ISIS activity indicators in contested areas

-

Scenario Planning: Investment strategies should incorporate scenarios ranging from stabilized regional arrangements to escalated conflict with broader international involvement.

The expiration of the Syria ceasefire with Kurdish forces represents a significant geopolitical development with measurable but contained implications for energy markets and regional investment risk. The 2-3% projected increase in Brent crude prices reflects legitimate supply concerns but also indicates that markets view this as a localized rather than systemic risk event [1].

The relatively modest scale of affected oil production (approximately 12,000 bpd from the Aydemir field) limits the direct supply impact, though the strategic implications of control transfer and regional stability concerns warrant continued monitoring. For investors, this development underscores the importance of maintaining geopolitical risk assessment capabilities and flexible portfolio positioning in an increasingly complex Middle Eastern security environment.

[1] CGTN - “Syria’s troops take control of Kurdish-led areas, including strategic town, oil fields & dam” (January 20, 2026)

https://news.cgtn.com/news/2026-01-20/VHJhbnNjcmlzdDg4NTkx/index.html

[2] OilPrice.com - Real-Time Oil Price API and Market Data (January 22, 2026)

https://www.oilpriceapi.com/

[3] Goldlyn AI - Market Indices Data (January 15-23, 2026)

Market data retrieved via Goldlyn API

[4] The National - “What happens next after Syria’s army offensive against the SDF”

https://www.thenationalnews.com/

[5] Graphic News - “Syria ceasefire in peril” (January 20, 2026)

https://www.graphicnews.com/

[6] The Cradle - “US envoy meets Turkish FM as Damascus, SDF ceasefire ‘collapses entirely’”

https://thecradle.co/

[7] Eurasia Press & News - Syria Conflict Coverage (January 2026)

http://eurasia.ro/

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。