POET Technologies: Photonics Play in AI Infrastructure - Reddit Hype vs. Fundamentals

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

The Reddit community on r/wallstreetbets shows strong bullish sentiment toward POET, with the original post scoring 297 points and generating 183 comments. Many users expressed intent to purchase calls or shares, citing technical support and bullish option flow. The proposed thesis centers on asymmetric upside through January 2026/2027 $10 calls, targeting $10-12 by year-end 2025.

However, significant skepticism exists in the comments. Users raised concerns about CEO insider selling and dilution risk, while noting repeated DD spam and price weakness despite purportedly bullish catalysts. Technical discussions highlighted gamma exposure and call walls, with debate over why the stock continues falling amid bullish flows. One commenter flagged the 20F filing as reading “like a penny stock,” warning of execution risk despite the strong technology moat.

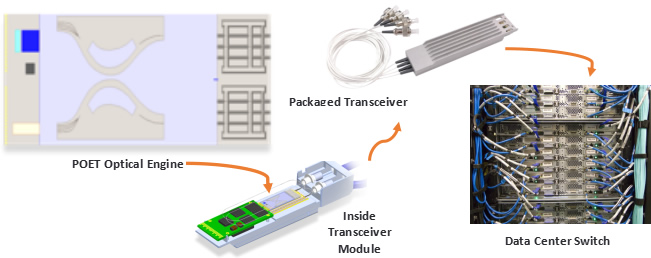

POET Technologies is a fabless semiconductor company that has developed the POET Optical Interposer platform, enabling seamless integration of photonics and electronics at the wafer level. The technology specifically targets AI data center connectivity, focusing on 800G/1.6T applications that replace copper with light for ultra-high-speed data transmission.

Key strategic developments include:

- Partnership with Semtech for 1.6T optical receivers launched in September 2024

- Equity stake acquisition in Sivers Photonics for external laser module collaboration

- $5M+ production orders from major systems integrators including Foxconn

- $150M oversubscribed registered direct offering in 2024

- Manufacturing operations in Malaysia with planned expansion

The company won the 2024 Best Optical AI Solution award and reached approximately $6.94 in late December 2024 with strong momentum grades. Insider trading activity was significant throughout 2024, with multiple officers exercising options and acquiring shares at prices ranging from $4.91 to $9.00.

Reddit’s bullish thesis aligns with fundamental catalysts, particularly the $150M funding round and strategic partnerships. However, the community’s price targets ($10-12) appear ambitious given the current ~$7 stock level and H2 2026 delivery timeline for the $5M production order.

The insider trading concerns raised on Reddit contrast with research showing officers exercising options and acquiring shares, suggesting management confidence rather than pure selling pressure. The “penny stock” characterization in Reddit comments seems overly harsh given the company’s legitimate technology and established partnerships with industry players like Semtech and Foxconn.

- Critical AI infrastructure bottleneck solution with strong market demand

- Established partnerships with Tier-1 partners (Semtech, Foxconn)

- First-mover advantage in optical interposer technology

- Macro tailwinds from AI data center expansion and small-cap rotation

- Execution risk on manufacturing scale-up in Malaysia

- Timeline risk with H2 2026 delivery for current production orders

- Competition from larger semiconductor players entering photonics space

- Dilution risk from future capital raises

- Technology adoption uncertainty in conservative data center market

POET represents a high-risk, high-reward play on AI infrastructure expansion. The technology addresses a genuine market need, and recent funding provides runway for commercialization. However, investors should be cautious of Reddit-driven momentum and focus on execution milestones, particularly the H2 2026 production deliveries.

For risk-tolerant investors, the January 2026/2027 $10 calls mentioned on Reddit could provide asymmetric upside if execution milestones are met, but position sizing should reflect the binary nature of the investment thesis.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。