META Investment Analysis: Evaluating Buy and Hold Opportunity After Recent Pullback

#META #buy and hold #valuation #AI investment #DAU #dollar cost averaging #AR/VR #momentum #intrinsic value

混合

综合市场

2025年11月16日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

META

--

META

--

Reddit Factors

Reddit investors show mixed sentiment on META’s current valuation opportunity:

Bullish Arguments:

- Average analyst target of ~$840 represents ~30% upside potential from current levels

- Intrinsic value estimates range from $800-$1,000, suggesting the recent dip is a buying opportunity

- Strong financial fundamentals and robust user base of 3.54B daily active users across family apps

- Several users advocate buying the dip and implementing dollar-cost averaging strategies

Bearish Concerns:

- Current ~30x P/E ratio may be too high given 7% EPS growth expectations

- Skepticism about AR/VR segment and Zuckerberg’s leadership

- Sustainability questions around reliance on algorithmic content and monetization challenges with WhatsApp

- Some investors waiting for steeper discount before entering positions

Research Findings

Meta’s Q3 2024 performance demonstrates strong operational momentum:

Financial Performance:

- Revenue grew 26% YoY to $51.24B, exceeding expectations of $49.6B

- Family of Apps revenue reached $50.77B vs $48.6B expected

- Ad impressions increased 14% while average price per ad rose 10%

- EPS of $1.05 missed consensus of $6.72 due to one-time tax-related charge

User Engagement:

- Daily active users across family apps grew to over 3.5 billion

- Maintained robust engagement metrics across platforms

AI Infrastructure Investment:

- Capital expenditures rose over 100% in Q3 2024

- 2025 capex guidance increased to $70-72 billion

- 2026 capex growth expected to be notably larger than 2025

- AI infrastructure spending may exceed $100 billion by 2026

Valuation Metrics:

- Current P/E ratio around 28.7x, in line with industry averages

- Analyst consensus shows predominantly positive sentiment with ‘Strong Buy’ and ‘Moderate Buy’ ratings

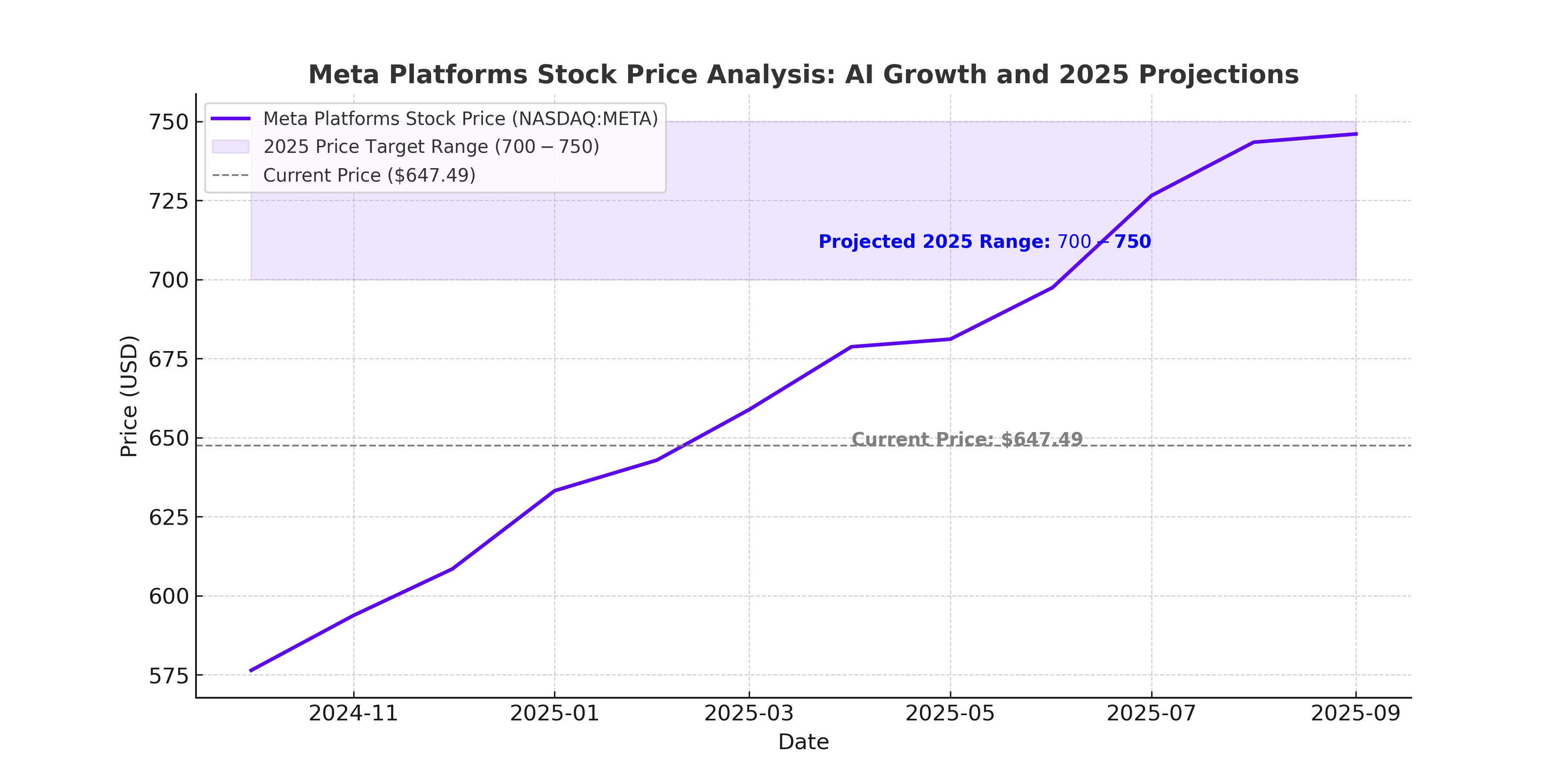

- Price targets mentioned range from $800-$930

Synthesis & Investment Implications

Convergence Points:

- Both Reddit discussions and research confirm strong user base (3.5B+ DAUs) as key value driver

- Agreement on robust financial performance and revenue growth trajectory

- Recognition of massive AI investment as both opportunity and risk factor

Key Contradictions:

- Reddit’s $550-$750 valuation range doesn’t align with research findings showing analyst targets of $800-$930

- Reddit concerns about 7% EPS growth may be outdated given Q3’s 26% revenue acceleration

- Research shows P/E of 28.7x vs Reddit’s 30x estimate - both reasonable given growth profile

Investment Thesis:

The recent pullback appears to offer a reasonable entry point, particularly for long-term investors comfortable with Meta’s aggressive AI investment strategy. The company’s strong revenue acceleration and massive user base provide solid fundamentals, while AI infrastructure investments position Meta for future growth despite near-term margin pressure.

Risks & Opportunities

Key Risks:

- Massive capital expenditures ($100B+ by 2026) could pressure margins and returns

- AR/VR segment remains unproven and capital-intensive

- Regulatory scrutiny and platform competition risks

- Execution risk on AI strategy and monetization

Primary Opportunities:

- AI infrastructure investments could create competitive moat and new revenue streams

- Strong advertising platform benefiting from AI improvements

- Cross-platform synergies across 3.5B+ user ecosystem

- Potential for multiple expansion if AI investments deliver expected returns

Recommendation:

Consider dollar-cost averaging into META positions, particularly on further weakness. The current valuation appears reasonable given growth prospects, but investors should be prepared for volatility as the market digests massive AI spending and its impact on future profitability.

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

META

--

META

--