META Investment Analysis: Bullish on Long-Term Value Amid AI Spending Concerns

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

The Reddit community shows mixed but generally bullish sentiment toward META at current levels:

- Valuation Optimism: Several users argue META’s intrinsic value ranges from $800-900, calling the recent dip a buying opportunity Reddit

- Analyst Alignment: One user cites average analyst price targets around $840 (30% upside) but personally avoids buying due to concerns about Zuckerberg and AR/VR traction

- AI Spending Skepticism: Key concern centers on whether massive AI investments will double ad revenue or become another Metaverse-like waste

- Fundamental Strength vs. Cash Burn: Users acknowledge strong fundamentals but flag cash burn risks, noting EPS could surge once spending slows

- Ad Product Concerns: Some investors stay away due to perceived poor quality of Meta’s core ad product

- Contrarian Signal: Negative sentiment is viewed by some as a contrarian bullish indicator, similar to past Mag7 reversals

- Downside Warning: One user warns big players may push the stock lower to ~$550 before a rebound

Professional analysis supports the bullish case while highlighting key risks:

- Strong Analyst Consensus: 77 Wall Street analysts maintain a Strong Buy rating with median price target of $850 (31.1% upside) [Research]

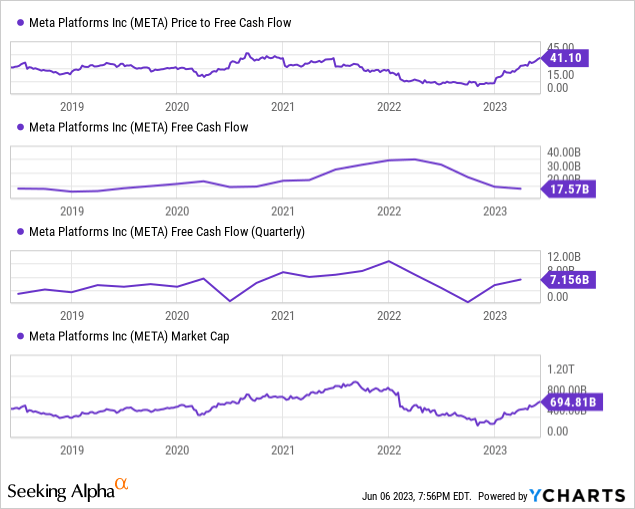

- Valuation Metrics: Current P/E ratios appear reasonable at 26.38 trailing and 24.63 forward, with fair value estimate of $863.20 (17% upside) [Research]

- Recent Pullback Drivers: Stock plunged 11.33% in one day (largest drop in three years) primarily due to AI infrastructure spending concerns [Research]

- Massive Investment Cycle: Meta raised 2025 capex guidance to $70-72 billion with even higher spending expected in 2026 [Research]

- Profitability Concerns: Total expense forecast for 2025 increased to up to $118 billion, creating an “air-pocket in sentiment” over the next 12-18 months [Research]

- Downgrade Risk: Oppenheimer recently downgraded META to Perform from Outperform, citing AI spending risks and rising costs [Research]

Both Reddit community members and professional analysts converge on META being undervalued with significant upside potential, though they express similar concerns about the massive AI spending cycle. The alignment is notable:

- Price Target Convergence: Reddit’s $800-900 intrinsic value estimates closely match the $850 analyst median target

- Shared AI Concerns: Both communities question whether AI investments will generate sufficient returns

- Timing Agreement: Both see potential for further short-term weakness before recovery

- Fundamental Acknowledgment: Strong core business fundamentals are recognized despite spending concerns

The key divergence lies in risk tolerance - some Reddit users avoid META due to leadership and product concerns, while analysts generally maintain Buy ratings despite acknowledging spending pressures.

- AI ROI Uncertainty: $70-72B+ in AI spending may not translate to proportional revenue growth

- Short-Term Volatility: Analysts warn of sentiment weakness over 12-18 months

- Execution Risk: Leadership and product quality concerns raised by community

- Further Downside: Potential for stock to drop to $550 levels before recovery

- Significant Upside: 31% upside to analyst targets, with some estimates suggesting 50%+ potential

- Valuation Discount: Current levels appear fundamentally undervalued relative to earnings power

- AI Leadership Position: Massive investments could establish dominant AI infrastructure advantage

- Contrarian Play: Negative sentiment may create optimal entry point for long-term investors

META appears suitable for risk-tolerant investors with 2-3 year time horizons who can withstand near-term volatility. Current levels offer attractive entry points, but investors should monitor AI spending effectiveness and be prepared for potential additional downside before the investment thesis plays out.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。